Tax Appeals for Railroad Property

The Best-Kept Secret Assessors Don’t Want You To Know

State, county, and local governments have zero incentive to make public the laws that provide tax-friendly arrangements for railroad operators. Taxing bodies remain reluctant to disclose these programs since they restrict their ability to tax railroad operating property in the same manner as industrial or other commercial property. Consequently, many railways and transload property owners and operators may be unaware that they can achieve dramatic tax savings by obtaining federal railroad designation thereby securing a substantial downward adjustment in their assessments through the state departments of revenue.

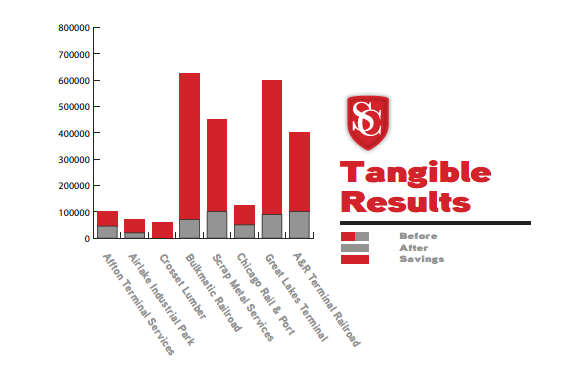

With a properly managed appeal, your property could qualify hundreds of thousands, and in some cases, millions of dollars in annual savings. It is not unusual for the taxes on locally assessed property to drop by as much as 75% or more once railroad designation is obtained.

You Could Own Railroad Operating Property and Not Even Know it

Property that is part of a supply chain that uses rail for the inbound or outbound transport or distribution of goods may qualify as railroad operating property. Many properties qualify just as they are. For others, only minimal adaptation and investment are needed to secure railroad designation. You may not even need railroad track leading onto or across your site to qualify.

Federal Transload Statute

Since the 1970’s the federal government has conferred tax benefits on railroad operating property to help the railroads compete with the trucking industry. These tax benefits have been enjoyed for decades by the major railroad companies everyone is familiar with, but many property owners whose businesses are part of the supply chain serviced by the major railroads are unaware that their property should also enjoy those tax benefits. Local assessing authorities have no interest in letting you know about this possibility. Indeed many assessors may be entirely unaware of it themselves.

How We Do It

By securing designation for your site as railroad operating property under the Federal Transload Statute, our firm extracts your property from the jurisdiction of the local assessor and places it under the jurisdiction of the State Department of Revenue. The State will assess your property as a part of the “rail unit assessment” which establishes the value of the entire railroad network of which it is a part. This reduces tax liability for most qualifying property owners by as much as 75% percent.

Contact Us

Do you own, lease, or operate an enterprise that uses railroad track, intermodal operations, or ancillary facilities? Owning, leasing, or operating railroad-related property and facilities fall into special property categories that require specific attention to assessment classification and fair evaluation. Let our seasoned attorneys and tax professionals show you how you can cut your tax liability to a mere fraction and free up your capital to help you achieve mission-critical objectives for your business.